capital gains tax increase canada

He reminds investors that there was no capital gains tax until 1972 when it was introduced at the 50-per-cent rate. Taxes must be paid on 50 of the gain at the marginal rate if your gross income is below 250000.

Capital Gains Tax In Canada Explained Youtube

Increasing the federal tax would be anti-investment anti-entrepreneurship anti-innovation and anti-green.

. The capital gains tax rate in Ontario for the highest income bracket is 2676. Gains inclusion rate may occur in the upcoming federal budget. If this were to happen the benefit of earning capital gains instead of income would be reduced.

The federal budget date has. This determines how much of your capital gains youll have to pay tax on. Exceeding this limit of 433456 2 times a LCGE of 866912 is capital gain arising from EQS dispositions in 2019.

During the year 2020 QSBCSs proceeds are excluded from capital gains deductions up to 441692 per LCGE amounting to 1289384. How Much Capital Gains Is Tax Free In Canada. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

For the past 20 years capital gains in Canada have been 50 taxable. Capital gains tax. In Canada the capital gains inclusion rate is 50.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. It was then increased to 6667 per cent in 1988 and then to a high of 75 per. Tax on capital gain 5353 b 10706 16059 0 0 Tax savings from 5041 donation tax credit c 25205 25205 25205 25205 Total cost of donation a b c 35501 40854 24795 24795.

So this means youll pay tax on half of your capital gains. May 26 2020 Niels Veldhuis. How Is Capital Gains Tax Calculated On Sale Of Property In Canada.

Capital gains tax hike would cripple investment in Canada. But another thing to consider is the inclusion rate. When the tax was first introduced to Canada the inclusion rate was 50.

A capital gains tax increase would be a form of annual wealth tax that would be. Of the total 546 percent was declared by taxpayers with incomes over 250000. There has been some desire from federal parties to increase the capital gains inclusion rate to 75 or higher.

And the capital gains tax rate depends on the amount of your income. Capital gains tax will be raised to 288 percent according to House Democrats. Currently its 50 in Canada but has been as high as 75 historically.

NDPs proto-platform calls for levying. In all Canadians realized 729 billion in taxable capital gains. This increased to 75 in 1990 and was then reduced back to 50 in 2000 where it has remained for the last 20 years.

Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. This is the income inclusion rate that generally applies to non-registered investments cottages rental. And the tax rate depends on your income.

To 75 from 50. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an estimated 190 billion annually or 57 per cent of all federal and provincial income tax revenues. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

The capital gain must be included in the annual income tax return and is taxed a percentage of that gain which is referred to as the inclusion rate. 250000 100000 150000 total capital gains Since your property is in Canada 50 of the total capital gains profit is subject to tax. Election platform the NDP proposed to increase the capital gains inclusion rate.

In Canada 50 of the value of any capital gains are taxable. So its not that capital gains are taxed at a rate of 50 but its that 50 of the capital gains are taxable. If two or more things are sold for over they were paid for it causes the CRA to pay an additional half 25 of the capital gain.

Capital Gains Tax Rate. This has Canada speculating again if a hike to the capital. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. The capital gains inclusion rate refers to how much of a capital gain is taxable.

According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing. For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be noted that capital gains are subject to the same top marginal rate of 5353 as income but given that only 50 of a capital gain is taxable it is common shorthand to refer to capital gains as.

At a time when the country faces momentous economic challenges its hard to think of a more damaging policy than a capital gains tax hike.

The Ultimate Canada Crypto Tax Guide 2022 Koinly

How Do Taxes Affect Income Inequality Tax Policy Center

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Capital Gains Tax Capital Gain Integrity

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

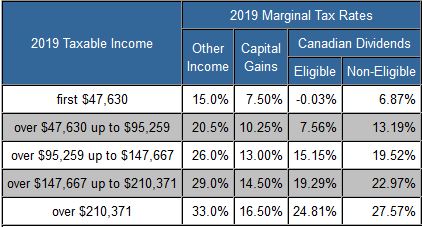

Taxtips Ca Federal 2018 2019 Income Tax Rates

Capital Gains Tax In Canada Explained

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Taxtips Ca Business 2020 Corporate Income Tax Rates

Capital Gains Yield Cgy Formula Calculation Example And Guide

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Do I Report Capital Gains In British Columbia

The Ultimate Canada Crypto Tax Guide 2022 Koinly

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Capital Gains Tax In Canada Explained

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories